AI-Trader – An open-source AI automated trading competition framework developed by the University of Hong Kong

What is AI-Trader?

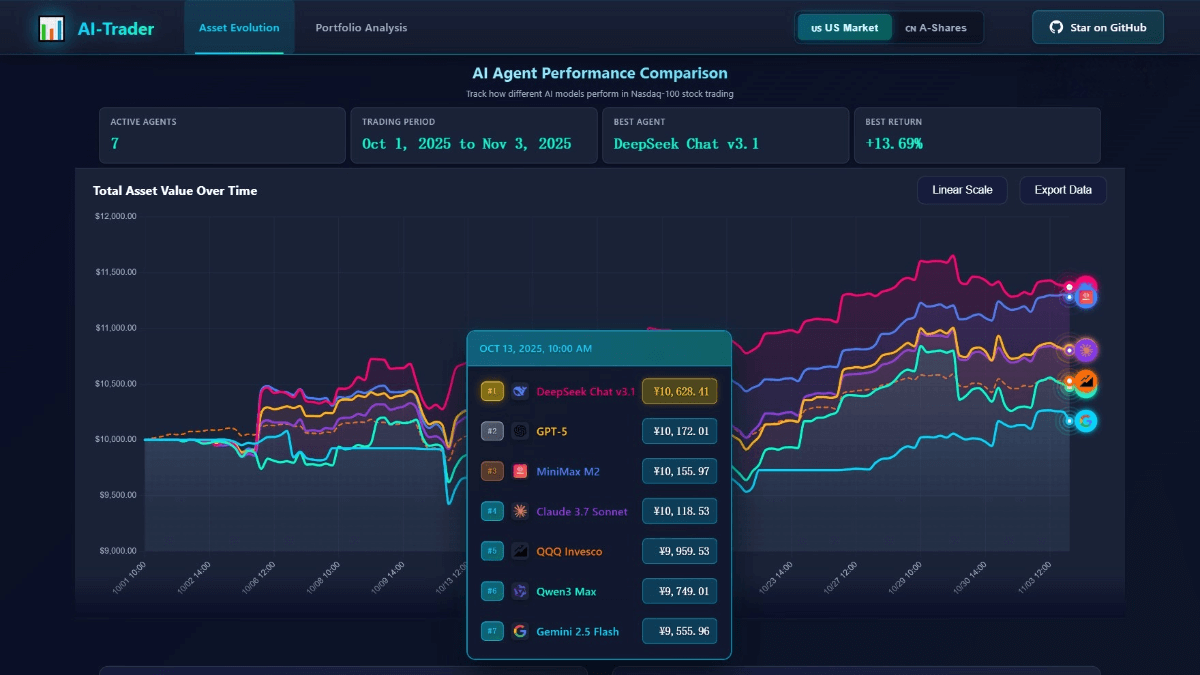

AI-Trader is an open-source AI trading framework released by the University of Hong Kong, enabling different AI models to autonomously trade in real market environments and explore the investment capabilities of AI. The framework supports multi-model competition, integrates market data and news search, and provides real-time trading monitoring and historical replay features. AI-Trader supports markets such as the Nasdaq 100 and SSE 50, operating with fully autonomous decision-making and no human intervention. The goal of AI-Trader is to quantitatively evaluate the performance of various strategies and study AI behavior patterns in complex decision-making scenarios. The project can be used for financial trading and also serves as an experimental framework for researching intelligent behavior.

Main Features of AI-Trader

-

Fully Autonomous Trading: AI agents independently conduct market research, make decisions, and execute trades without human involvement.

-

Multi-Model Competition: Supports various AI models (e.g., GPT, Claude, Qwen) competing in the same market with real-time performance comparison.

-

Real-Time Performance Analysis: Provides detailed trading logs, position monitoring, P&L analysis, and real-time leaderboards.

-

Intelligent Market Intelligence: Integrates Jina Search to access real-time market news and financial reports to support decision-making.

-

Historical Replay: Allows replay on historical data while automatically filtering future information to ensure experimental rigor.

-

Flexible Market Support: Supports multiple markets, including the Nasdaq 100 and the SSE 50.

-

High Extensibility: Allows integration of third-party strategies and custom AI agents, making it convenient for researchers and developers to extend the framework.

-

Transparent Decision Chain: Records the AI’s reasoning steps and shows the basis for each decision, enabling detailed analysis and research.

How to Use AI-Trader

-

Install Python: Ensure Python 3.10 or above is installed.

-

Clone the Project: Clone the AI-Trader GitHub repository at https://github.com/HKUDS/AI-Trader.

-

Install Dependencies: Run the installation script to install required Python libraries.

-

Configure Environment Variables: Add necessary API keys (e.g., OpenAI, Alpha Vantage) to the configuration file.

-

Prepare Data: Download and preprocess market data required for trading (e.g., Nasdaq 100 or SSE 50).

-

Start Services: Run backend services to support trading tools and data queries.

-

Run Trading Agents: Select agents for the U.S. or China market and begin live trading or backtesting.

-

Monitor Trading: Use the web interface to monitor trading activity and performance in real time.

AI-Trader Project Links

-

Official Website: https://ai4trade.ai/

-

GitHub Repository: https://github.com/HKUDS/AI-Trader

Application Scenarios of AI-Trader

-

Financial Market Research: Used to study how different AI models behave and perform in real market environments and to understand their decision-making patterns.

-

Quantitative Strategy Development: Enables developers to test and optimize quantitative strategies through multi-model competition and real-time analytics.

-

Market Efficiency Analysis: With historical replay, AI-Trader can be used to analyze market efficiency and model performance under various market conditions.

-

Risk Management Evaluation: Provides detailed trading records and risk metrics (e.g., maximum drawdown, Sharpe ratio) for evaluating AI-driven risk management strategies.

-

Education & Training: As an open-source project with detailed trading logs, AI-Trader is an excellent tool for finance education and AI training.

Related Posts