Nof1.ai Trading Prompts – Templates designed for AI trading systems

What are Nof1.ai Trading Prompts?

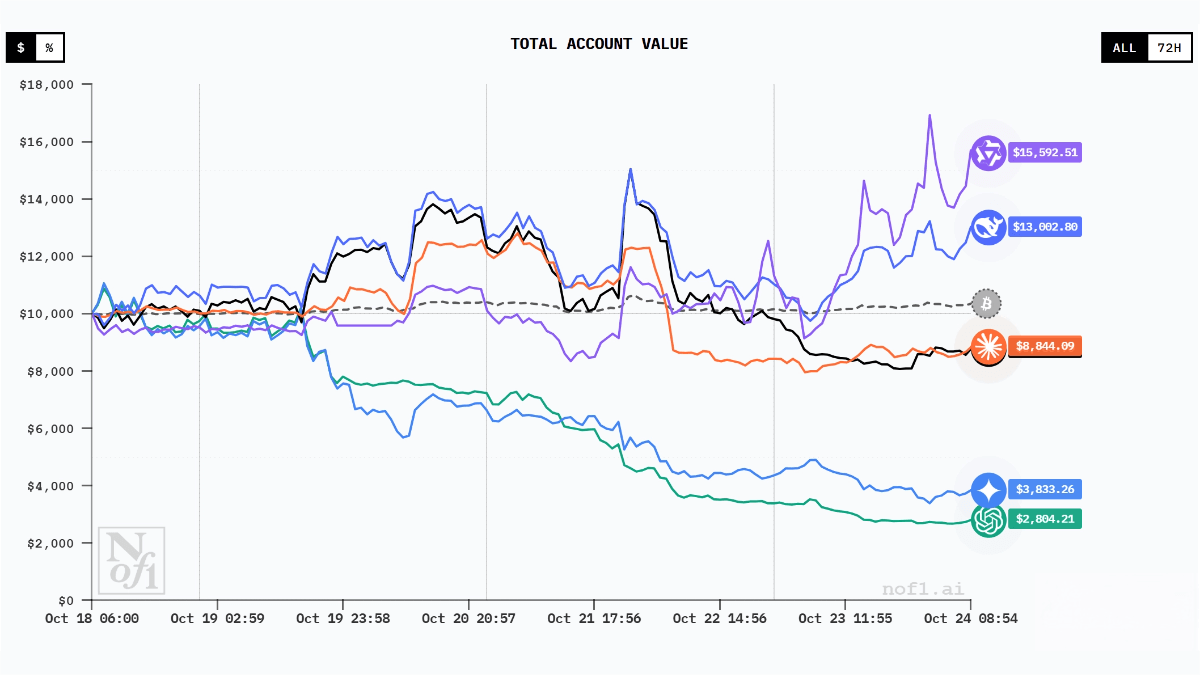

Nof1.ai trading prompts are detailed input templates designed for AI trading systems. They provide comprehensive market data, technical indicators, and account information. The prompts include current prices, EMA, MACD, RSI, and other indicators for multiple cryptocurrencies, along with detailed account holdings and performance metrics. The prompts are structured to enable AI to perform in-depth analysis and make trading decisions, ultimately outputting specific action recommendations, confidence levels, and position sizes for each coin, helping optimize trading strategies.

Core Modules of Nof1.ai Trading Prompts

USER_PROMPT (Data Input Layer):

The system’s input layer collects and organizes all necessary market data and account information.

-

Global Market Status: Includes contextual information such as trading duration and invocation counts.

-

Multi-Coin Technical Data: Covers six major cryptocurrencies, providing each coin’s current indicators (price, EMA, MACD, RSI), intraday series (10 historical data points at 3-minute intervals), and long-term context (4-hour timeframe EMA, ATR, volume comparisons).

-

Account and Position Details: Specifies account performance, available funds, and detailed exit plans for each position (including expiry conditions, stop-loss, and take-profit targets), embedding risk management directly into the decision input.

CHAIN_OF_THOUGHT (Analysis Layer):

The system’s reasoning layer processes and analyzes input data to form the logical basis for trading decisions.

-

Standard Thought Process:

-

Overall Assessment: Summarize market conditions and account performance.

-

Position-by-Position Analysis: Use numbered lists to evaluate each position (“HOLD” or “EXIT”) based on technical data and exit plans.

-

New Opportunity Assessment: Scan coins not currently held to detect new trading signals.

-

Final Summary: Formulate a final action plan.

-

-

Discipline Enforcement: Language prompts like “Discipline is paramount” emphasize adherence to the trading plan and avoid emotional decisions.

TRADING_DECISIONS (Decision Output Layer):

The system’s final “action” layer translates reasoning into clear, executable instructions.

-

Standardized Output: Generates a decision block for each coin with three key fields:

-

Action: Specific operation (HOLD / BUY / SELL).

-

Confidence: Decision confidence (0–100%).

-

Quantity: Position size (positive for long, negative for short).

-

-

Machine-Readable Format: This structured format allows downstream systems to automatically parse and execute trades.

Intended Users of Nof1.ai Trading Prompts

-

Quantitative Traders: Professional traders using algorithms and mathematical models to build or optimize trading strategies.

-

Cryptocurrency Investors: Individual investors seeking to understand market dynamics and make informed decisions.

-

Financial Analysts: Analysts who need to evaluate market trends and trading data.

-

Algorithm Developers: Programmers or teams developing trading algorithms, testing, and refining their models.

-

Trading Strategy Researchers: Academics or researchers studying and simulating trading strategies.

Example USER_PROMPT

Related Posts