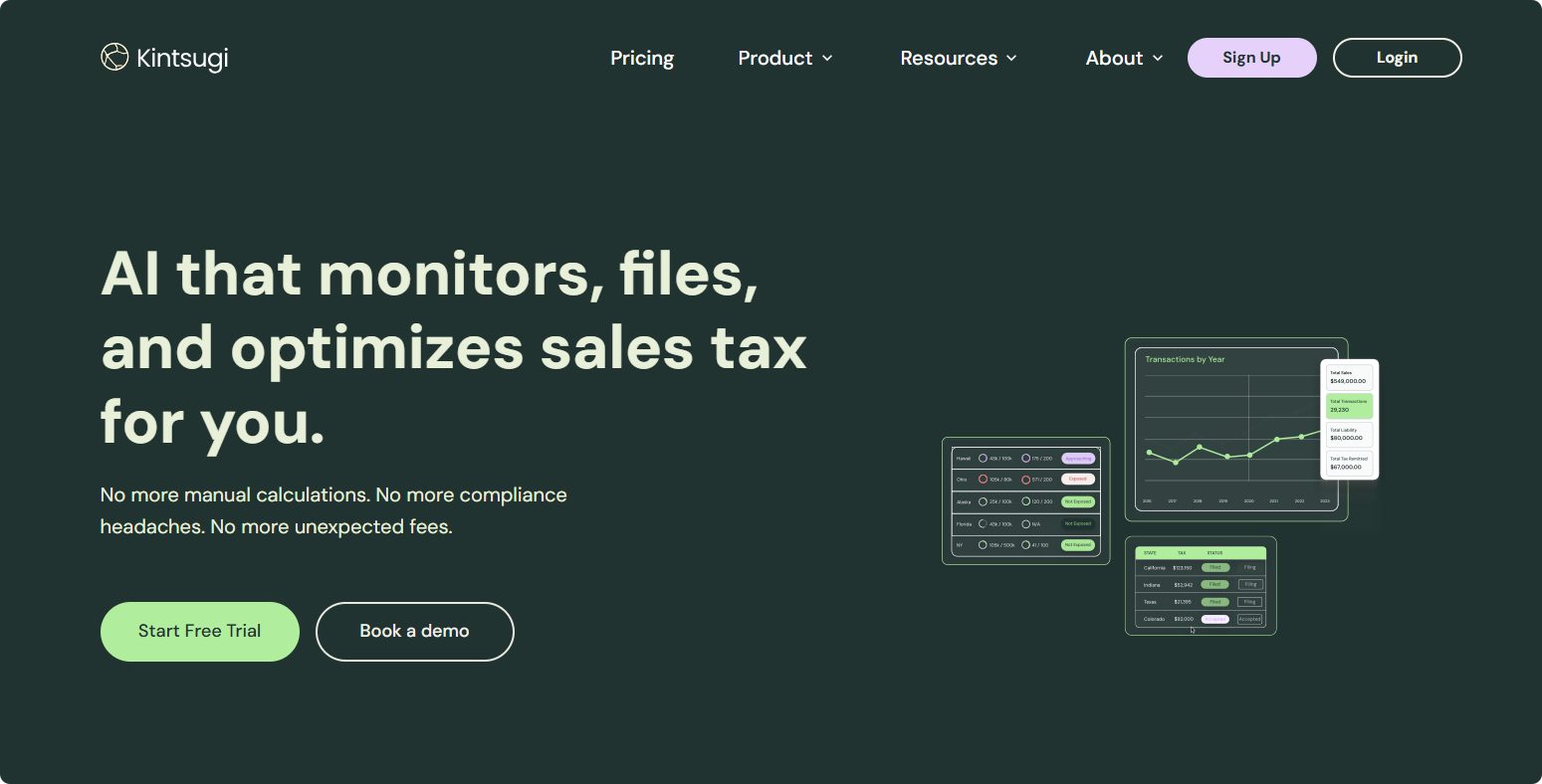

Tax Zen in 3 Minutes: Kintsugi AI – Your Smart Companion for Global Sales Tax Compliance

What is Kintsugi?

Kintsugi is an AI-powered platform designed to automate and simplify sales tax compliance for businesses operating globally. Whether you’re a startup or an international e-commerce brand, Kintsugi provides end-to-end automation—from tax calculation and registration to filing and remittance—minimizing manual tasks and ensuring full compliance across jurisdictions.

Key Features

-

Real-Time Nexus Monitoring & Alerts

Automatically tracks economic nexus thresholds across all U.S. states and notifies businesses when registration is required—helping you avoid costly penalties. -

One-Click Registration & Filing

Seamlessly registers your business in required jurisdictions and handles tax filings on time, hassle-free. -

Exemption Certificate Management

Centralizes and validates customer exemption certificates, streamlining the compliance process. -

TaxGPT AI Assistant

An intelligent assistant built into the platform that offers tailored sales tax insights and answers complex tax questions. -

Global Remittance Support

Enables effortless cross-border tax remittance, making it suitable for global enterprises. -

Effortless Integrations

Offers easy-to-use APIs and plug-and-play integration with e-commerce platforms, billing systems, and invoicing tools.

How It Works – The Tech Behind the Magic

Kintsugi leverages cutting-edge artificial intelligence to automate the sales tax lifecycle. Using machine learning and rule-based automation, it processes real-time sales data to detect nexus obligations and file accurate tax returns based on the latest regulations.

Key technologies include:

-

AI-Powered Nexus Detection

Uses geolocation and sales analytics to determine where your business has tax obligations. -

Automated Workflow Engine

Executes end-to-end processes—from registration to remittance—through customizable triggers and rules. -

Real-Time Dashboards

Provides live visibility into compliance status, tax liabilities, and filing deadlines. -

Enterprise-Grade Security

Compliant with GDPR, SOC 2 Type II, and other global standards, ensuring data privacy and integrity.

Project Links & Resources

-

Official Website: https://trykintsugi.com

-

Free Trial Sign-Up: https://auth.trykintsugi.com/signup

-

Blog & Insights: https://trykintsugi.com/blog

-

Case Studies: https://trykintsugi.com/case-studies

Use Cases

-

Multi-State E-Commerce Sellers

For Shopify, Etsy, or Amazon merchants needing to manage complex tax compliance across states. -

SaaS Providers

Subscription services offered in multiple jurisdictions that require precise tax handling. -

Freelancers & Consultants

Independent professionals working across state lines who must file correctly to avoid penalties. -

Small & Midsize Businesses

Companies looking to save time and reduce the cost of sales tax compliance. -

Accounting & Finance Teams

Departments aiming to boost productivity with smarter, automated tax solutions.

Conclusion

In today’s global and digital economy, sales tax compliance is more than just a checkbox—it’s a strategic necessity. Kintsugi empowers businesses with AI-driven automation, allowing them to stay compliant while focusing on growth.

Start your free trial at https://trykintsugi.com and experience the future of tax automation today.

Related Posts