Kronos – An Open-Source Financial Candlestick Chart Foundation Model by Microsoft and Tsinghua University

What is Kronos?

Kronos is the first foundation model for financial candlestick charts, jointly open-sourced by Tsinghua University and Microsoft Research Asia. It analyzes candlestick data of assets such as stocks and cryptocurrencies—including open, high, low, close prices, and trading volume—to predict future price movements.

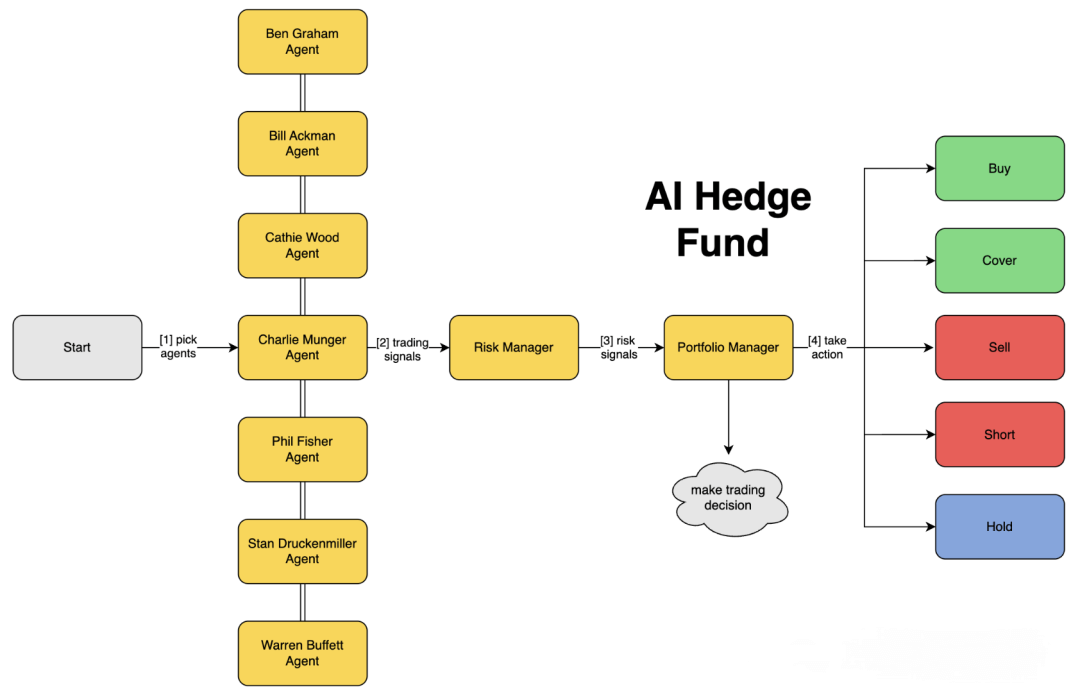

Kronos adopts a two-stage processing framework:

-

An intelligent tokenizer converts continuous candlestick data into discrete “financial vocabulary.”

-

A Transformer-based predictive model learns patterns from historical data to forecast future trends.

The training data covers more than 45 global exchanges, enabling Kronos to handle the volatility and noise inherent in financial data.

Kronos provides multiple model sizes, ranging from 4.1M to 499.2M parameters, to fit different needs. It requires only 4 lines of code to load, automatically generating predictions from historical input data. It offers a real-time BTC/USDT prediction dashboard, integrates with Qlib for backtesting, and supports A-share market data.

On benchmark datasets, Kronos achieves:

-

93% higher RankIC in price sequence prediction compared with leading TSFM.

-

87% improvement over the best non-pretrained baseline.

-

9% lower MAE in volatility prediction.

-

22% improvement in synthetic candlestick sequence generation fidelity.

Key Features of Kronos

-

Candlestick Chart Interpretation: Analyzes candlestick data (open, high, low, close, volume) to predict future market movements.

-

Two-Stage Framework: Tokenizes continuous K-line data into discrete “financial vocabulary,” then uses a Transformer-based model to forecast future trends.

-

Multiple Model Options: Provides pretrained models ranging from 4.1M to 499.2M parameters, suiting various computational and application needs.

-

Ease of Use: Requires only 4 lines of code to load and run predictions.

-

Real-Time Prediction Demo: Offers a BTC/USDT dashboard displaying future trends.

-

A-Share Market Support: Integrated with Qlib for backtesting, with a full fine-tuning pipeline for custom trading strategies.

-

High-Performance Forecasting: Significantly outperforms existing baselines in price prediction, volatility forecasting, and candlestick sequence generation.

Technical Principles

-

Two-Stage Processing: Intelligent tokenizer + Transformer-based predictive model.

-

Intelligent Tokenizer: Converts raw candlestick data into discrete symbols understandable by the model.

-

Transformer Architecture: Captures long-term dependencies in time-series data for more accurate forecasts.

-

Pretraining & Fine-Tuning: Offers pretrained models that can be fine-tuned for specific financial markets or tasks.

-

Multi-Source Training Data: Trained on data from 45+ global exchanges for strong generalization.

-

Time-Series Modeling: Designed to handle volatility and noise in financial data, extracting valuable predictive signals.

Project Links

-

GitHub Repository: https://github.com/shiyu-coder/Kronos

-

arXiv Paper: https://arxiv.org/pdf/2508.02739

Application Scenarios

-

Stock Market Forecasting: Predicts stock price movements to support investment decisions.

-

Cryptocurrency Trading: Analyzes crypto price volatility to assist traders in strategy-making.

-

Quantitative Strategy Development: Provides market trend predictions for refining quantitative trading signals.

-

Market Sentiment Analysis: Reflects shifts in investor sentiment via candlestick interpretation.

-

Risk Management: Assists in risk assessment and mitigation by forecasting potential market downturns.

-

Financial Research: Supports research on market dynamics, price formation, and market efficiency.

Related Posts