TradingAgents: A Multi-Agent LLM Framework for Financial Trading

What is TradingAgents?

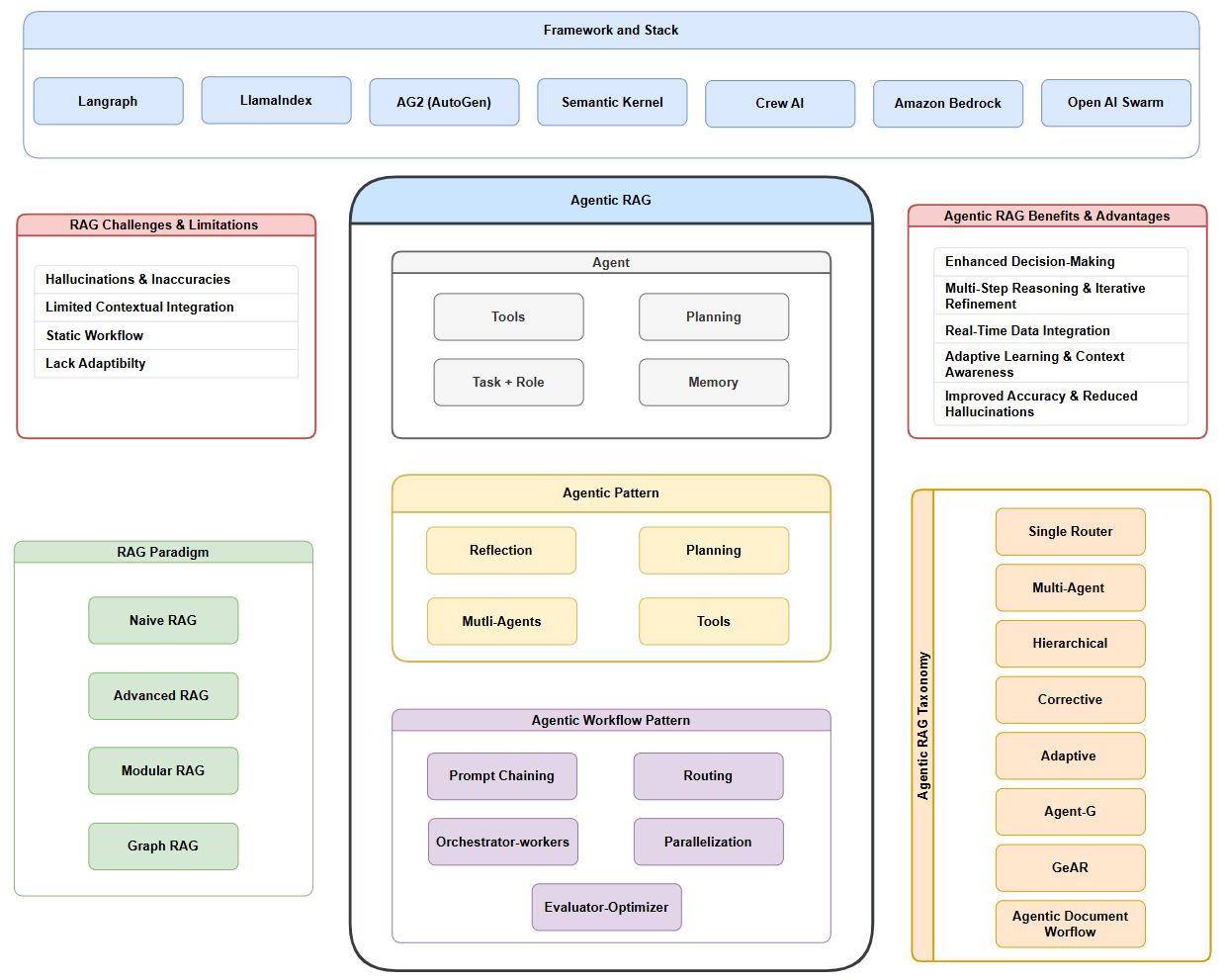

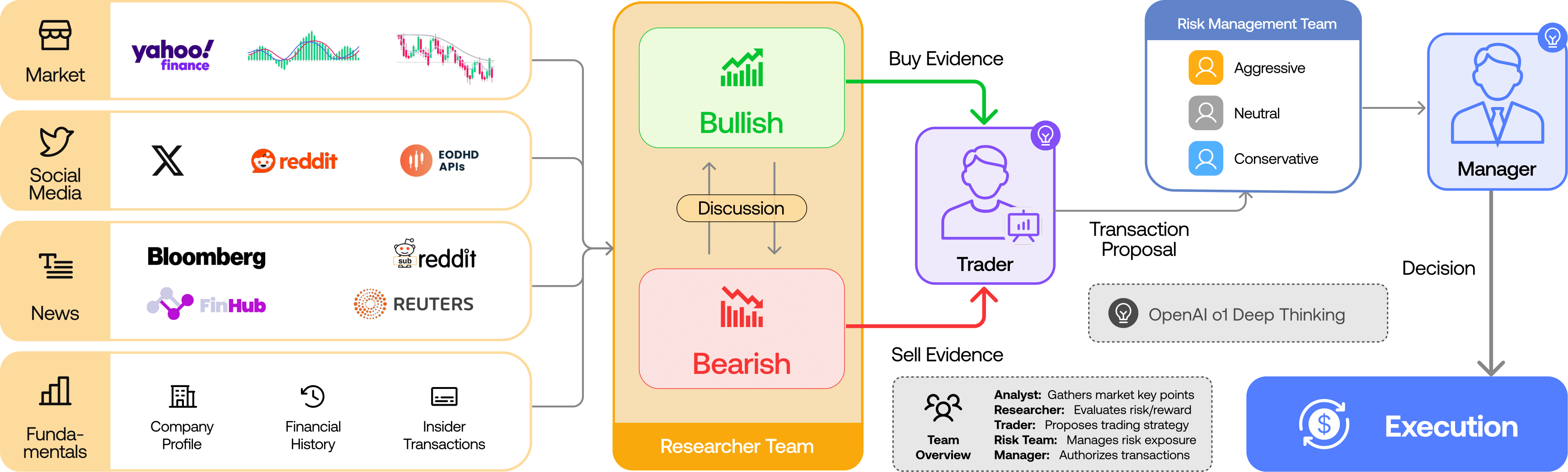

TradingAgents is an open-source multi-agent financial trading framework designed to simulate the collaborative workflow of a real trading firm, leveraging large language models (LLMs) to enhance automated trading decision-making. The framework builds multiple agent roles such as fundamental analysts, sentiment analysts, technical analysts, researchers, traders, risk managers, and portfolio managers to create a complete trading ecosystem. Each agent performs analysis and decision-making within their expertise, with traders consolidating these insights to execute trades.

Main Features

-

Multi-role Agent Collaboration: Includes roles like fundamental analysts, sentiment analysts, technical analysts, researchers, traders, risk managers, and portfolio managers, simulating real trading firm teamwork.

-

Deep Analysis and Decision-Making: Utilizes LLMs for deep reasoning and rapid responses, analyzing market data to generate trading recommendations.

-

Risk Management: Evaluates market volatility, liquidity, and other factors to adjust trading strategies and maintain portfolio risk control.

-

Simulated Trade Execution: Executes trading commands in a simulation environment to evaluate strategy effectiveness.

-

CLI and Python Interfaces: Provides command-line and Python APIs for easy experimentation and integration.

Technical Principles

TradingAgents is built on LangGraph to ensure modularity and flexibility. In experiments, it uses models like o1-preview and gpt-4o for deep reasoning and quick responses, with recommendations to use o4-mini and gpt-4.1-mini for cost-efficient testing. The framework supports online tools and cached data, allowing users to choose based on needs. It offers rich configuration options enabling customization of LLMs, debate rounds, and other parameters to fit different experimental requirements.

Project URL

-

GitHub Repository: https://github.com/TauricResearch/TradingAgents

-

Project Homepage: https://TradingAgents-AI.github.io/

Application Scenarios

-

Quantitative Trading Research: Used for developing and testing multi-agent collaborative trading strategies to improve robustness and adaptability.

-

Financial Market Analysis: Provides comprehensive market assessments through simulations of various analytical roles, supporting investment decisions.

-

Education and Training: Offers a simulated trading environment for finance professionals to learn strategies and risk management.

-

Automated Trading System Development: Serves as a foundational framework for building multi-agent automated trading systems, supporting rapid prototyping and experimental validation.

Related Posts