Agentar-Fin-R1 – A Financial Reasoning Large Model Released by Ant Group Digital Technologies

What is Agentar-Fin-R1?

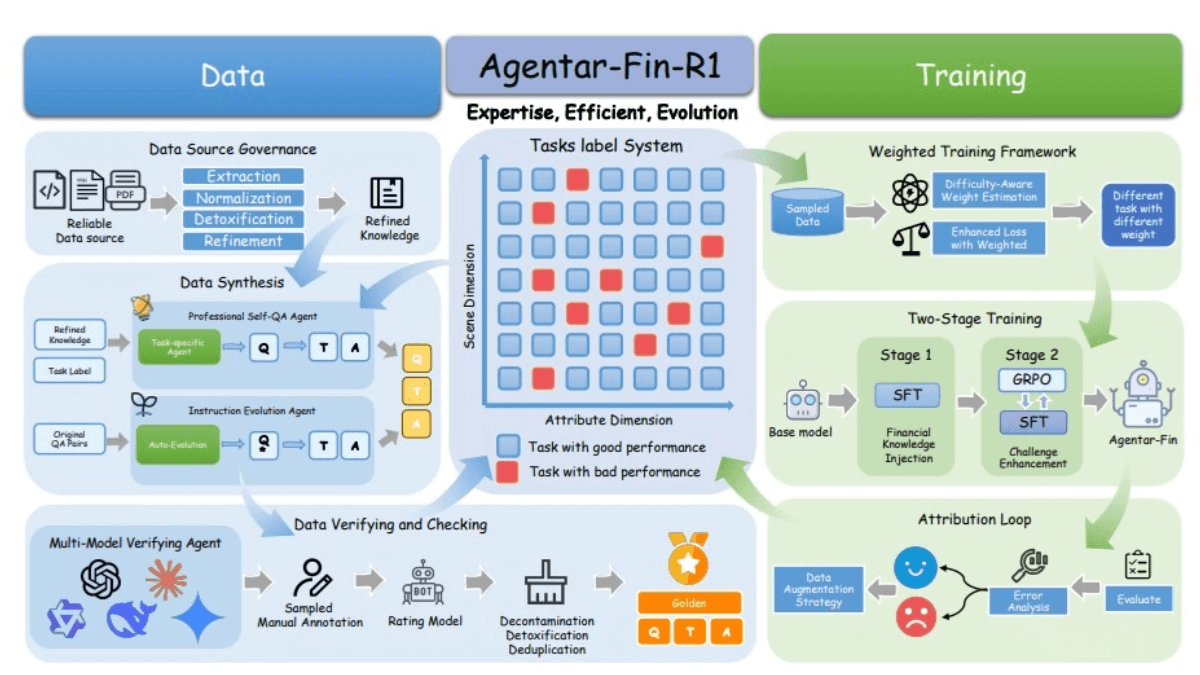

Agentar-Fin-R1 is a large language model developed by Ant Group Digital Technologies, specifically designed for the financial domain. It enhances reasoning capabilities, trustworthiness, and domain expertise in financial scenarios. Built upon the Qwen3 base model, Agentar-Fin-R1 is available in 8B and 32B parameter versions. It is optimized through a finely tuned financial task tagging system and a multi-layer trustworthiness assurance framework. A three-stage, label-driven data pipeline ensures data source reliability, synthetic data quality, and governance integrity. The model has demonstrated outstanding performance on financial benchmarks such as Fineva, FinEval, and FinanceIQ, as well as general reasoning benchmarks like MATH-500 and GPQA-diamond, proving its excellence in both financial intelligence and general-purpose reasoning.

Key Features of Agentar-Fin-R1

-

Advanced Reasoning: Capable of handling complex financial tasks involving multi-step analysis, risk assessment, and strategic planning.

-

Decision Support: Delivers deep reasoning and data-driven insights to support smarter decision-making in dynamic financial markets.

-

Intent Recognition: Accurately identifies user intent in financial scenarios, such as investment inquiries, product exploration, and risk assessments, enabling personalized services.

-

Slot Recognition & Information Extraction: Precisely extracts structured information from financial texts, such as fund names, insurance products, or stock codes, for downstream processing.

-

Tool Planning & Recommendations: Recommends suitable financial tools based on user needs, including portfolio analysis or market comparison tools, enhancing productivity and experience.

-

Professional Expression Generation: Produces accurate and regulation-compliant financial language, ensuring transparency and legal alignment.

-

Security Risk Detection: Identifies and mitigates malicious inputs, data leakage, and system abuse, maintaining system integrity.

-

Regulatory Compliance: Demonstrates a deep understanding and strict adherence to AML, data privacy, investor protection, and risk disclosure regulations.

Technical Principles of Agentar-Fin-R1

-

Refined Financial Task Tagging System:

Agentar-Fin-R1 employs a fine-grained task tagging system that breaks down the financial domain into well-defined categories across business sectors (e.g., banking, securities, insurance) and task types (e.g., intent recognition, slot filling, risk assessment). This enables a structured, task-driven optimization process covering diverse financial reasoning tasks. -

Multidimensional Trustworthiness Assurance:

To guarantee high-quality data, the model implements a three-layered trust framework:-

Trusted Source: Data sourced from reputable institutions and regulatory materials, processed via knowledge engineering to ensure authenticity and relevance.

-

Trusted Synthesis: High-quality synthetic data generated through multi-agent collaborative frameworks with peer discussion and review.

-

Trusted Governance: Manual sampling, deduplication, toxicity filtering, and self-developed reward-based filtering mechanisms ensure safety and reliability.

-

-

Weighted Training Framework:

Uses a dynamic, task-sensitive weighted training approach:-

Difficulty-Aware Weighting: Tasks are weighted based on pass@k scores to prioritize complex problems.

-

Exponential Smoothing & Clipping: Ensures stable training and convergence.

-

-

Two-Stage Training Strategy:

-

Stage 1: Injects comprehensive financial knowledge via large-scale supervised fine-tuning (SFT).

-

Stage 2: Applies reinforcement learning (GRPO) and targeted fine-tuning to boost performance on complex tasks.

-

-

Attribution Loop:

Introduces an attribution loop for performance improvement via targeted error analysis:-

Error Attribution: Uses a two-dimensional tagging framework to classify prediction errors.

-

Dynamic Resource Allocation: Allocates training resources to underperforming areas for focused enhancement.

-

-

Innovative Finova Evaluation Benchmark:

Agentar-Fin-R1 introduces the Finova benchmark to evaluate model performance in real-world financial settings across three dimensions:-

Agent Capabilities: Intent recognition, slot filling, tool planning, and expression generation.

-

Complex Reasoning: Covers financial mathematics, code understanding, and multi-step logic for real decision simulations.

-

Safety & Compliance: Assesses the model’s ability to detect risks and adhere to regulatory standards.

-

-

Efficient Data Synthesis & Verification:

Utilizes a dual-track data synthesis strategy that combines knowledge-guided generation with instruction evolution. Validation is ensured through multi-model consistency checks and human sampling.

Project Links for Agentar-Fin-R1

-

arXiv Technical Paper: https://arxiv.org/pdf/2507.16802

Application Scenarios for Agentar-Fin-R1

-

Intelligent Financial Customer Service: Manages multi-turn dialogues, continuously understands user intent, and guides them through complex financial tasks such as account opening, transfers, and investment consulting.

-

Risk Assessment & Management: Evaluates portfolio risk levels, provides early warnings, and suggests management strategies to help investors make smarter decisions.

-

Market Trend Analysis: Analyzes market data to detect trends and patterns, offering real-time insights for financial institutions.

-

Financial Report Analysis: Uses NLP to parse and analyze financial statements, delivering detailed analytical reports for analysts.

-

Personalized Product Recommendations: Suggests suitable financial products—such as funds, insurance, or wealth management plans—based on user preferences and historical behavior.

Related Posts