AI Hedge Fund: An Open-Source Platform for Building a Virtual Investment Team

What is an AI Hedge Fund?

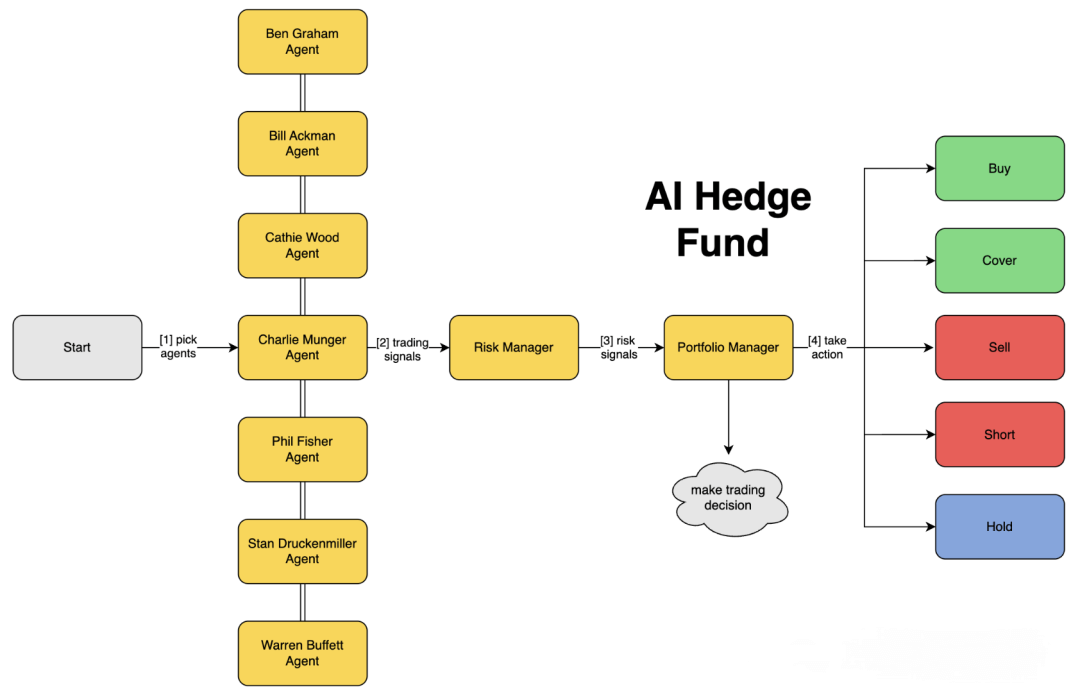

AI Hedge Fund is an investment strategy simulator based on the styles of several renowned investors such as Warren Buffett, Charlie Munger, and Bill Ackman. It includes signal generators and risk management tools. The project can simulate different investment strategies and evaluates opportunities using valuation, fundamentals, market sentiment, and technical indicators. Additionally, the risk manager calculates risk metrics and limits positions, while the portfolio manager is responsible for the final trading decisions, including buying, selling, shorting, or holding.

Key Features

-

Multi-Agent Collaborative Decision-Making: The system simulates the investment styles of famous investors, including:

-

Aswath Damodaran: Valuation expert focusing on narrative, numbers, and rigorous valuation.

-

Ben Graham: Father of value investing, focusing on hidden value stocks with margin of safety.

-

Bill Ackman: Activist investor who takes bold stances and drives change.

-

Cathie Wood: Growth investing queen who believes in innovation and disruption.

-

Charlie Munger: Warren Buffett’s partner, buys only great companies at reasonable prices.

-

Michael Burry: Contrarian investor searching for deep value.

-

Peter Lynch: Practical investor looking for “tenbaggers” in everyday business.

-

Phil Fisher: Detailed growth investor using in-depth “scuttlebutt” research.

-

Stanley Druckenmiller: Macro investing legend seeking asymmetric growth opportunities.

-

Warren Buffett: The Oracle of Omaha, focusing on reasonably priced quality companies.

-

Valuation Agent: Calculates intrinsic stock value and generates trading signals.

-

Sentiment Agent: Analyzes market sentiment and generates trading signals.

-

Fundamentals Agent: Analyzes fundamental data and generates trading signals.

-

Technicals Agent: Analyzes technical indicators and generates trading signals.

-

Risk Manager: Calculates risk metrics and sets position limits.

-

Portfolio Manager: Makes final trading decisions and generates orders.

-

-

Simulated Trading Decisions: The system simulates investment decisions without executing real trades.

-

Educational and Research Tool: Designed to provide learners and researchers a platform to understand AI’s application in finance.

Technical Principles

-

Multi-Agent System: By simulating multiple legendary investors’ styles, the system demonstrates different investment strategies.

-

Trading Signal Generation: Multiple agents analyze various data sources to produce combined trading signals.

-

Risk Management: The simulated risk management agent shows how risk factors are incorporated into investment decisions.

Project Links

-

GitHub Repository: https://github.com/virattt/ai-hedge-fund

Application Scenarios

-

Education and Learning: Suitable for students in finance, AI, and machine learning to understand AI applications in financial decision-making.

-

Research and Development: Provides researchers a platform to explore multi-agent systems in finance.

-

Simulation and Testing: Offers developers an environment to test and validate different investment strategies and models.

Disclaimer

-

For Educational and Research Use Only: This project is intended solely for education and research, not real trading or investing.

-

No Investment Advice: The project does not provide investment advice or guarantees.

-

No Liability for Financial Loss: The creators are not responsible for any financial losses.

-

Consult Professional Advisors: Always consult professional financial advisors before making investment decisions.

-

Past Performance Is Not Indicative of Future Results: Historical performance does not guarantee future outcomes.

Related Posts