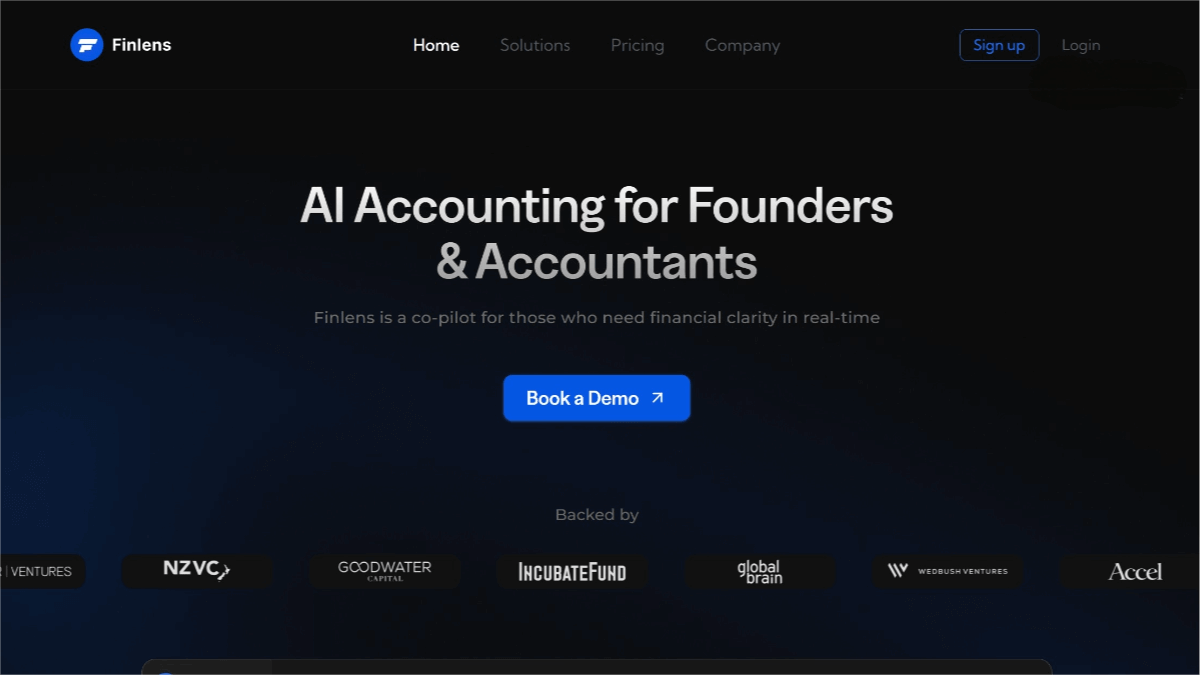

Finlens – An AI-powered financial management platform for real-time cash flow and spending trend analysis

What is Finlens?

Finlens is an AI-powered financial management platform designed for startups and accountants. By connecting to bank accounts and credit cards in real time, it automatically categorizes transactions, generates financial reports, and offers intelligent spending insights to help users organize financial data efficiently and save time. Key features include real-time financial insights, AI-driven expense analysis, invoice and payables management, and collaboration tools for teams. Built on top of QuickBooks, Finlens requires no data migration, ensuring data accuracy and real-time updates. Users can easily monitor key financial metrics, cash flow, and spending trends. With secure collaboration tools, Finlens reduces the need for emails and meetings, improving team productivity. It is ideal for startup founders and accountants who want to focus on business growth while maintaining financial clarity and accuracy.

Key Features of Finlens

-

Automatic Transaction Categorization: AI automatically identifies and categorizes transactions from bank accounts and credit cards, minimizing manual input.

-

Real-Time Financial Dashboard: Visualizes real-time data on cash flow, income sources, and expenses.

-

Invoice and Payables Management: Enables users to create and send invoices, track accounts receivable and accounts payable.

-

Seamless QuickBooks Integration: Directly syncs with QuickBooks without data migration, ensuring data consistency.

-

AI-Powered Predictive Analytics: Offers financial trend forecasting and key metric analysis based on historical data to support decision-making.

-

Multi-Account Connectivity: Supports connecting multiple bank accounts and credit cards for centralized financial management.

-

Secure Data Protection: Employs bank-grade encryption to ensure the security of financial data.

-

Team Collaboration Tools: Provides collaboration features for finance teams, CFOs, and accountants, simplifying communication and task management.

Official Website of Finlens

- Website: https://www.finlens.app/

Application Scenarios for Finlens

-

Startup Financial Management: Helps founders quickly organize financial data and view real-time cash flow and spending trends.

-

Efficient Collaboration for Accounting Firms: Ideal for firms managing multiple client accounts—Finlens simplifies workflows with team collaboration tools, allowing accountants to share reports and assign tasks, while CFOs can approve transactions in real time.

-

Automated Investor Reporting: Startups that need to regularly report to investors can use Finlens to automatically generate professional financial reports. Reports can be exported in GAAP-compliant formats and shared directly with investors, enhancing professionalism.

-

Multi-Project or Client Management: With key financial metrics, automated bookkeeping, and collaboration features, Finlens is well-suited for managing multiple projects or clients efficiently.

Related Posts